Phreesia (PHR): A growth story in the healthcare tech space

Expect $67 share price (25-30% upside) -- originally published on March 27, 2021

Disclaimer: The content herein is for informational purposes only. This publication does not in any manner constitute investment, financial, or other advice. Nor is it a solicitation, recommendation or endorsement to buy or sell any securities or other financial instruments. Please do your own due diligence before making investment decisions.

Investment thesis (quick summary):

- Market may be under-estimating growth: This really is the crux of this investment thesis. My estimate is that the market is pricing in a 20-25% revenue growth for FY 2021-22, whereas I expect a growth rate of ~30%+ YoY. Growth levers (with conservative growth impact estimates) include:

o Return of patient volume to baseline levels – 7% impact

o COVID vaccinations spike (which I haven’t included in my growth assumptions)

o Expansion to acute care market – 5% impact

o Expansion of sales team – 25% impact

o Total expected growth: ~40%; putting a haircut factor to account for potential double counting of impact and things that can go wrong, 30%+ yoy topline growth is my conservative estimate.

Given the high gross margins (65%+) and expecting not too different fixed costs from market expectations, the higher than expected top-line growth should also translate into a nice bump for earnings vs. expectations

In my estimate, this increased growth potential should translate to a ~25-30% upside for the share price. The expectation is that the management improves their guidance in the upcoming earnings call (on March 31st) or in the next one, and creates upward momentum on the stock price.

- Good company at reasonable valuation, which ensures long term prospects are not bad even if the earnings play doesn’t pan out as predicted

o Growing and recession immune industry niche: Healthcare is relatively recession immune; and digitization in healthcare administration is a secular trend expected to continue (replacing paper forms is a win-win for both patients and admin)

o Reasonably valued growth SaaS company – more details below

o Market leader and best in class product: Market leader in their niche (patient intake); product rated as best in class by independent organizations.

- Potential risks:

o The stock is up 66% in the last 6 months; sharp gains are often sharp to fall as well if market sentiment turns

o Company only meets / underperforms growth / profitability expectations

o Insider selling of shares can depress prices (there’s been some of late)

o Management quality is unclear

o Unclear if there’s a strong moat for the business; the ad-based revenue model can provide protection against price undercutting – but risks remain.

Business overview: Phreesia is a healthcare SaaS platform that digitizes the patient intake process (currently focused on ambulatory / outpatient practice but now expanding to acute care / inpatient care).

Revenue sources: (1) Subscriptions (45%) (2) Payment processing (37%) & Advertising (18%)

Investment thesis (more details on select parts of the thesis):

- The company trades at a reasonable valuation relative to peers: Let’s start here since it lays the foundation for how revenue / margin growth will likely impact valuations. The numbers below are only meant to give a directional sense of the valuation.

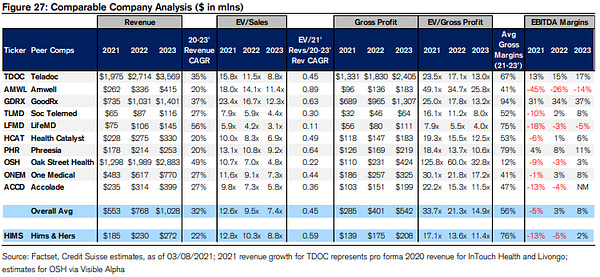

As you can see from below estimates from Credit Suisse, Phreesia trades at ~18.5x of 2021 Gross Profit (I prefer EV/Gross profit over EV/Sales for evaluating SaaS companies given that cost of sales % tend to vary quite a bit across companies making comparability less precise), which is well below the avg. of 34x for healthcare tech / SaaS peers. (Note also that not all companies listed here are SaaS companies – but it’s a close enough peer set; if we remove LifeMD, Him & Hers and Oak street Health to get to a closer peerset – i.e., more SaaS like companies – we get an average of 26.5x EV/ Gross profit multiple)

The lower valuation is to some extent justified since the average company is expected to grow revenue at a 32% yoy growth rate (and 27.5% if we remove the non-similar companies) whereas Phreesia’s estimated growth rate is 20% yoy. However, as you’ll see from my thesis below, Phreesia is likely to grow at a much faster clip, thus deserving a more premium valuation.

- Revenue growth potential is under-estimated – improved revenue guidance in earnings calls can lead to a spike in valuation: Let’s start with understanding market expectations. Phreesia guided a FY 2020-21 revenue of $146M and a 20-25% growth for FY2021-22 (that translates to ~$180M in FY2020-21 revenue if we assume the midpoints for these guided estimates). When these were announced, the share price stayed at ~$55 for about 2 weeks and then moved up to $80 before falling back in the last couple of days (driven by a couple of factors which I’ll get into later). So, the market pricing for the guidance likely corresponds to a share price somewhere in between. Let’s be conservative and assume that the management guidance corresponds to a share price of $55. Note that avg. analyst price target is ~$67.5 with a revenue estimate of $180M for FY21-22 – so that’s some validation that we may be conservative (though to be fair, analyst valuations are often a tad optimistic as well). Bottomline: Market currently prices current management guidance estimates at ~$55 per share, which is roughly where it’s trading at today.

With that, let’s move to why revenue is expected to grow faster than the guided 20-25%.

o Patient visits expected to return to baseline levels, which increases revenue: Patient visits declined by ~15% cumulatively in 2020 (see breakdown by specialty; source: Phreesia-Harvard research Feb 2021). However, visits are catching up with baseline trends as you can see from chart below (and likely will exceed baseline in 2021 as a result of pent-up visits for smaller ailments, covid vaccination visits).

Payment processing fees and advertising revenue (total 55% of revenue) are directly proportional to patient usage / visits. While subscription revenue isn’t directly impacted, scaling and implementation slowed down and there was the occasional payment forgiveness which impacts subscription revenues. However, conservatively assuming no impact on subscription revenue, estimate that with visits returning to normal (and not accounting for extra vaccination visits), revenue should see a ~7% bump in 2021. I.e., 1.07X expected impact.

o Phreesia focused only on ambulatory visits, but now has expanded focus to acute care, with their focus being on cross-selling acute care offering to providers who have both facilities. They expect this to form a bigger part of their revenue (and expect minimal additional sales effort here since many of these practices already use Phreesia for their ambulatory care). I’m assuming a 5% increased revenue from existing clients / 5% more potential from new clients as a result. I.e., 1.05X expected impact.

o Sales team expansion: As of Dec ’19, Phreesia had about 60 sales reps. This stayed flat through the end of July (and briefly during lockdown, most if not all the sales team was redeployed to other teams). As of Dec ’20, the number of reps increased to ~100 (a 67% increase).

Between the FY ending on Jan 31st 2020, and the FY ending Jan 31st 2021 (yes, they use Jan 31st as their FY end date), Phreesia is expected to grow it’s revenue by 18%. Given the sales to revenue generation cycle of ~180 days, it’s fair to say that the ~60 sales reps drove the 18% yoy growth (in fact, it’s conservative since many of those reps were redeployed during lockdown months to other functions). Now, with a bigger baseline revenue, assuming similar levels of productivity, this 60 can drive another 15% growth. And the additional 40 reps, assuming similar levels of productivity will drive an additional 10% revenue growth. Total expected impact is 1.25X

o Total impact on revenue accounting for all above: ~40% top line growth. Put a conservative haircut factor, and we still see 30%+ top line growth.

- A SaaS company growing at 30% YoY puts Phreesia above its peers on average in terms of growth rate and margins, and thus ideally valuation multiples. Conservatively, if we assume a 22.5x EV / FY 21 Gross profit multiple (midpoint between Phreesia’s current EV/Gross profit of 18.5x and its peer set’s 26.5x), Phreesia’s Enterprise value comes out to be 22.5 x ($190M*65% gross margin) = 2.8B.

Add in the net cash position of ~$0.2B and we get a market cap of $3.0B. That corresponds to a share price of $67, which in turn corresponds to ~27% upside from today’s price.